Market Analysis Review

JPY Higher, AUD Lower despite recovery in Risk Sentiment; final Manufacturing PMIs, RBA Meeting overnight

Rates as of 05:00 GMT

Market Recap

JPY continues to strengthen! This is a catastrophe for me as my older daughter is still in university in Japan. She now costs me about 4.5% more than she did just a little over a week ago!

It’s also a puzzle. JPY has been strengthening recently on thoughts that the global economy is weakening and therefore the Fed (and presumably other central banks as well) aren’t likely to tighten as much as had been feared. That means the interest rate differential with Japan won’t widen as much as people had expected, making JPY more attractive (or less unattractive, whichever).

The surprising decline in US GDP on Thursday reinforced this idea and led to broad USD weakness. It also triggered a “bad news is good news” reaction in stocks, since it led people to think the Fed would begin to loosen earlier than they had expected. The S&P 500 was up 1.2% on Thursday and 1.4% on Friday.

This combination means two different forces pulling JPY in different directions: the shrinking expected interest rate differential, which would normally lead to a stronger JPY, and the improving risk sentiment, which would normally lead to a weaker JPY.

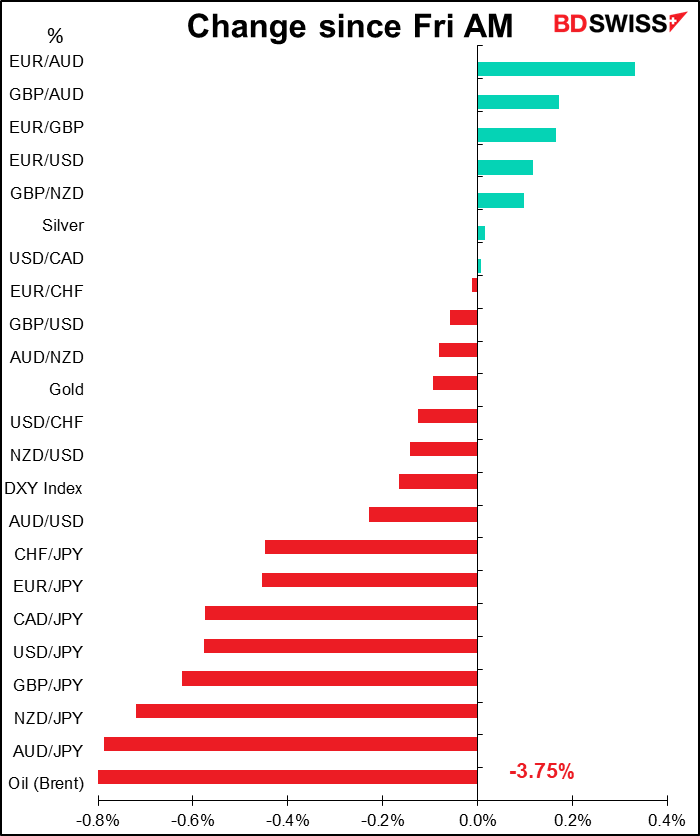

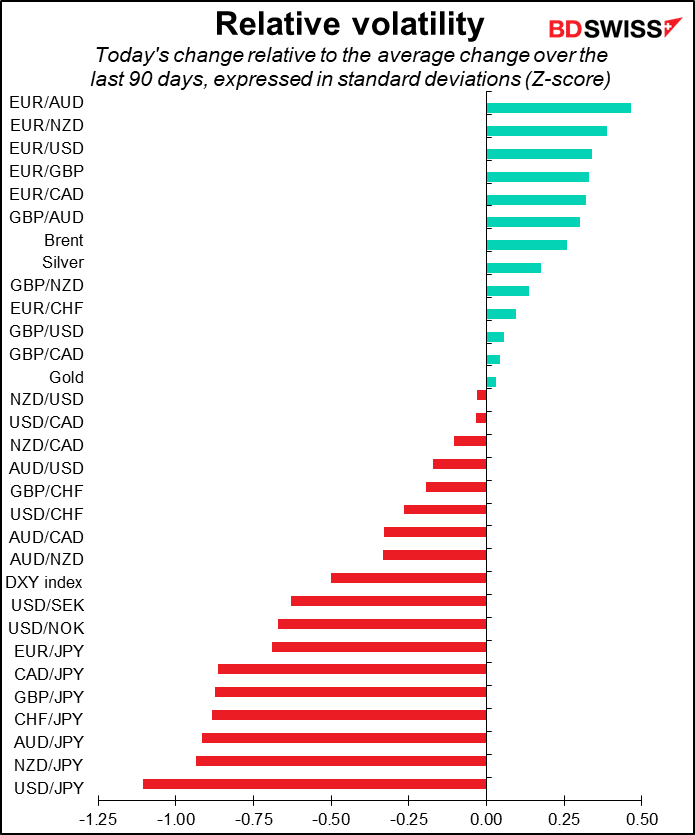

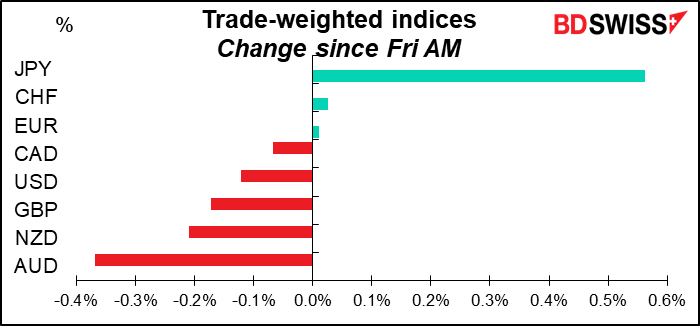

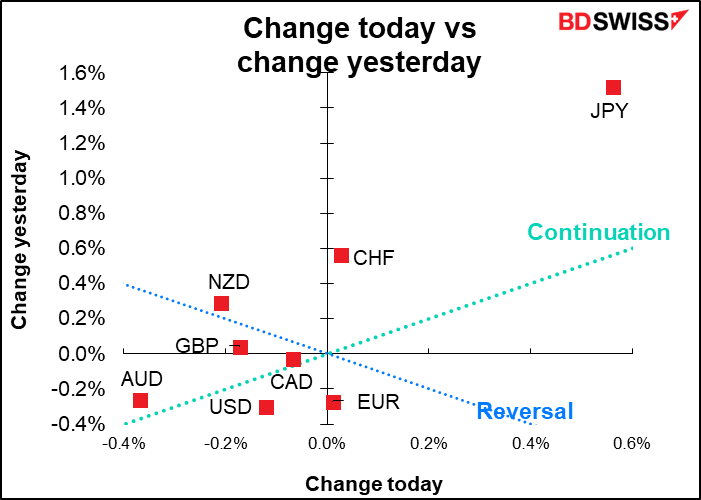

In the event, JPY not only gained vs USD but also against the risk-sensitive commodity currencies, such as AUD.

This is unusual. In the past, the combination of lower expected interest rates and a recovery in risk sentiment led to broad JPY weakness. But we not only saw the opposite of this on Thursday but also on Friday as JPY suddenly started to appreciate around midday in Tokyo. It looked like end-month rebalancing flows in a quiet market were exaggerating the price action, but JPY has continued to appreciate today despite the higher-than-expected US personal consumption expenditure (PCE) deflators announced on Friday.

I still think JPY is likely to weaken in the future. That’s because I think the Fed is wrong when it says that a 2.5% fed funds rate is “neutral.” Not when inflation is 9.1% yoy! Neutral would be somewhere around 10.8%. I think the Fed is likely to hike much, much more, once again leaving the Bank of Japan in the dust. But it may take some time for the markets to realize this. The next US consumer price index (CPI) comes out a week from Wednesday (Aug. 10th). That might be the trigger for a reversal in JPY. Although the market forecast for the headline figure currently is a decline to 8.8% yoy, core inflation is expected to accelerate to 6.2% yoy from 5.9%. A further rise in core inflation would indicate to the Fed that its tightening measures so far weren’t stopping the spread of inflation and might increase calls for more dramatic action.

Commitments of Traders (CoT) report

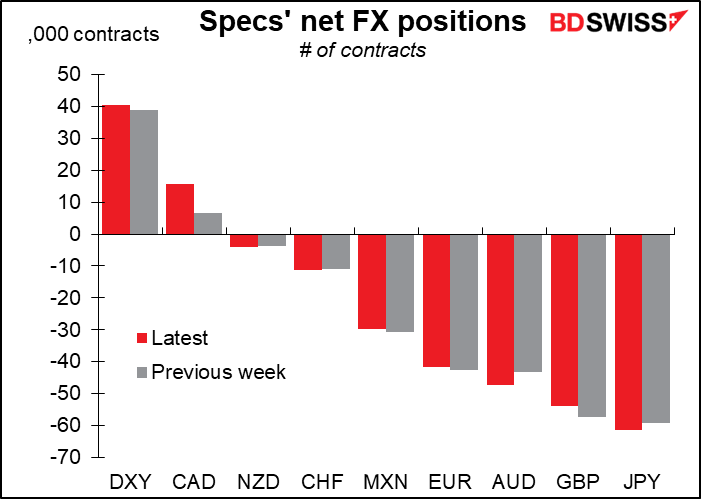

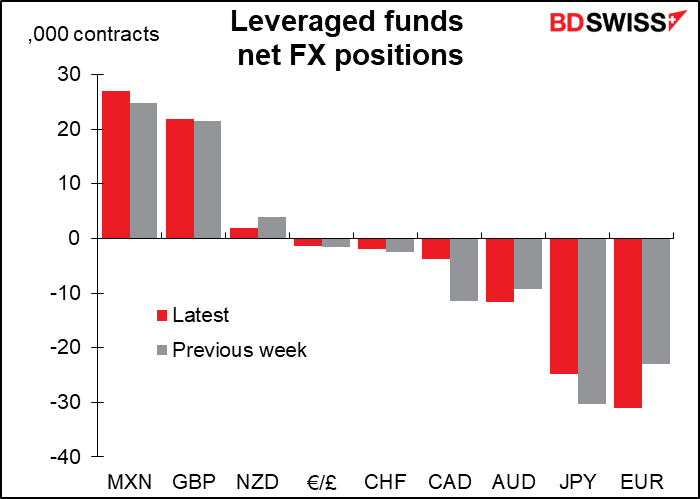

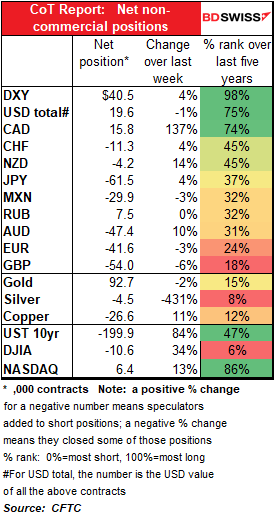

Almost no change in the net dollar exposure of speculators over the last week. The biggest change was an increase in CAD longs, which was offset by a small increase in AUD and JPY shorts. Otherwise…well as I did point out last Monday, this week tends to be the quietest week of the year.

Hedge funds were more active – they increased their EUR and AUD shorts while trimming their JPY and CAD shorts.

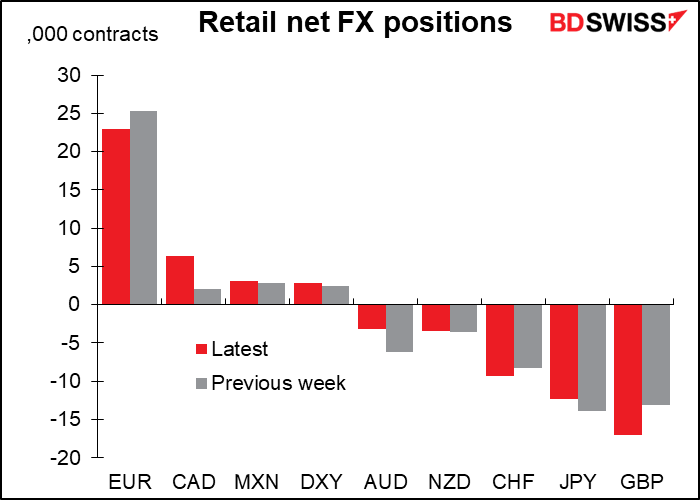

Retail had some big changes, particularly doubling their long CAD position and trimming short AUD by half. They also increased their short GBP by a third.

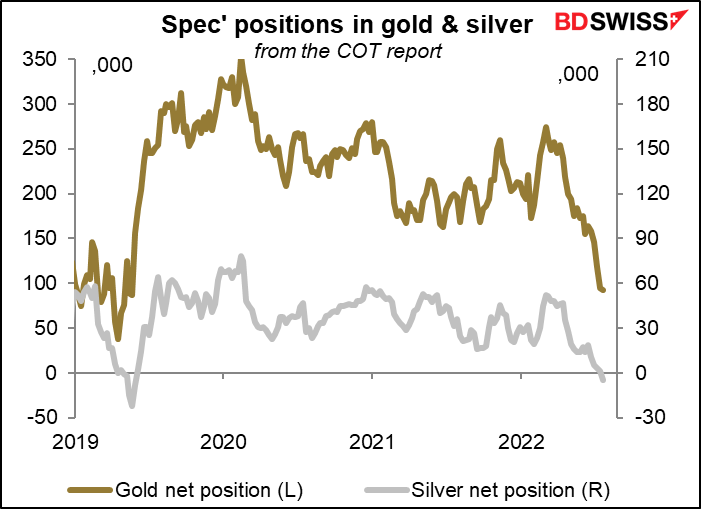

Speculators continued to reduce their long positions in precious metals. As expected, they went short silver for the first time in a bit over three years.

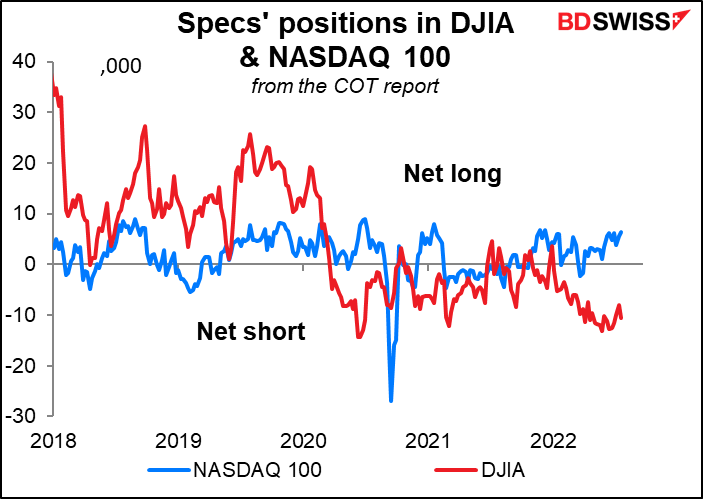

As for views on the stock markets…speculators are still long the NASDAQ 100 but short the DJIA. Interesting as the DJIA is down 9.6% yoy and the NASDAQ is down 20.8%. I guess they’re positioned for the rebound.

Today’s market

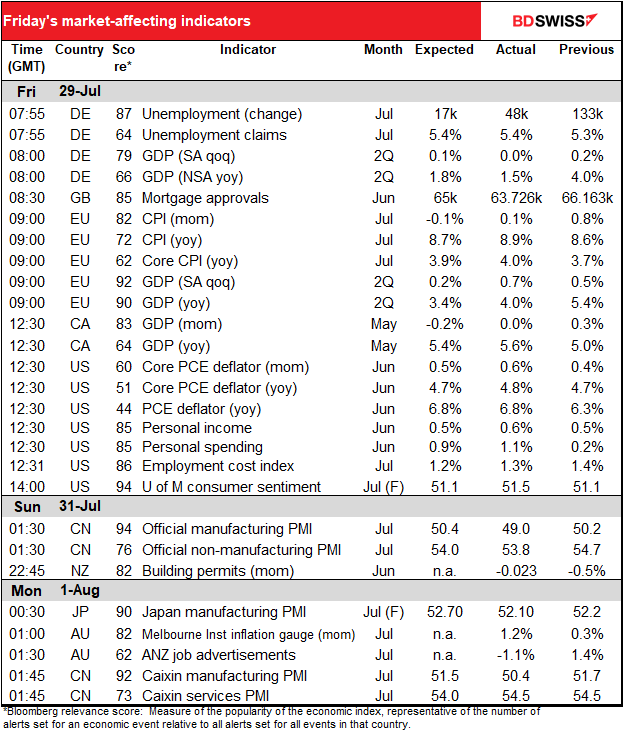

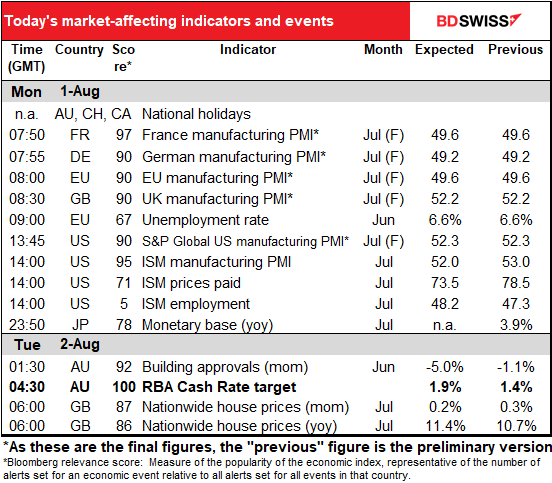

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

It’s a holiday today in Australia, Switzerland, and Canada, so somewhat reduced activity in those countries’ currencies today.

Otherwise the main thing on the schedule is the manufacturing purchasing managers’ indices (PMIs), the final ones for those countries that have preliminaries and the one-and-onlies for those that don’t.

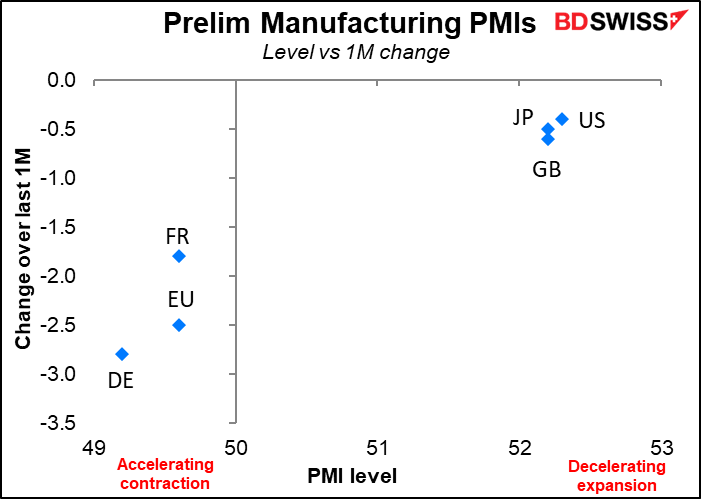

The preliminary figures showed the situation worsening around the world. Europe, despite its surprisingly high Q2 GDP, seems to be falling off a cliff.

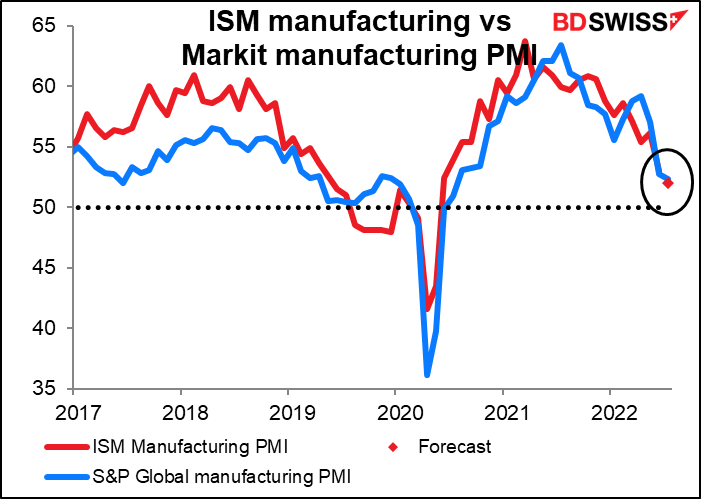

Along with the final PMIs comes the closely watched Institute of Supply Management (ISM) manufacturing PMI for the US. It’s forecast to fall 1 point, more than the 0.4 point that the S&P Global version declined but leaving them in about the same place (ISM 52.0 vs S&P Global 52.3).

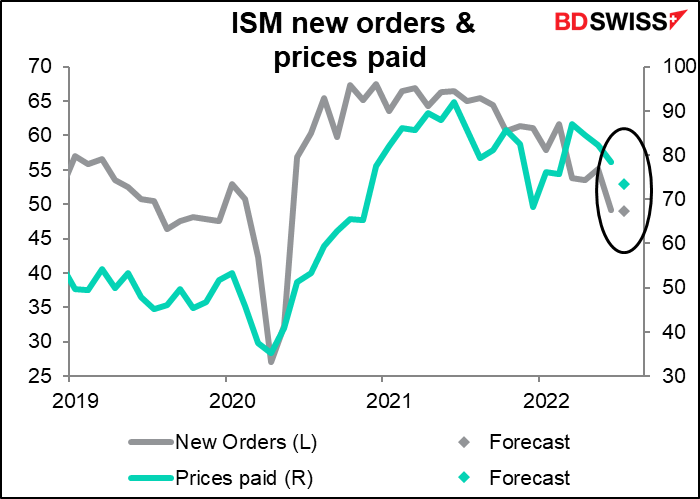

New orders are expected to fall to 49.0, below the 50 line that signifies the divide between expansion and contraction. In other words, new orders are expected to fall into contractionary territory. And the “prices paid” index is expected to decline a sharp 5.0 points, although remaining quite high at 73.5 (meaning most of the companies are still seeing the prices of their inputs moving higher).

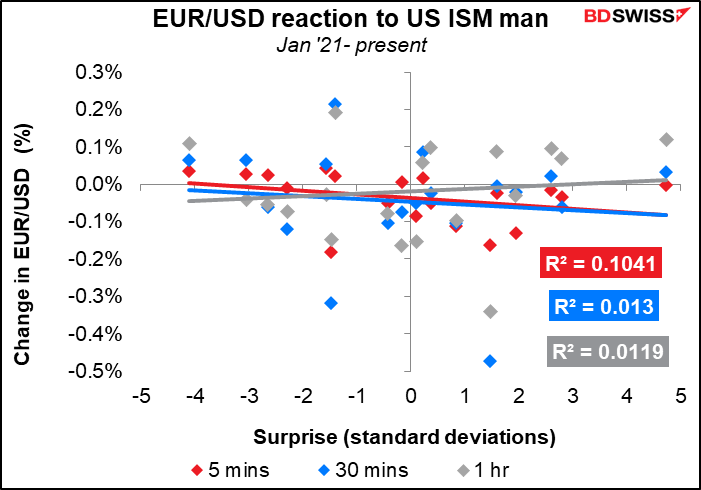

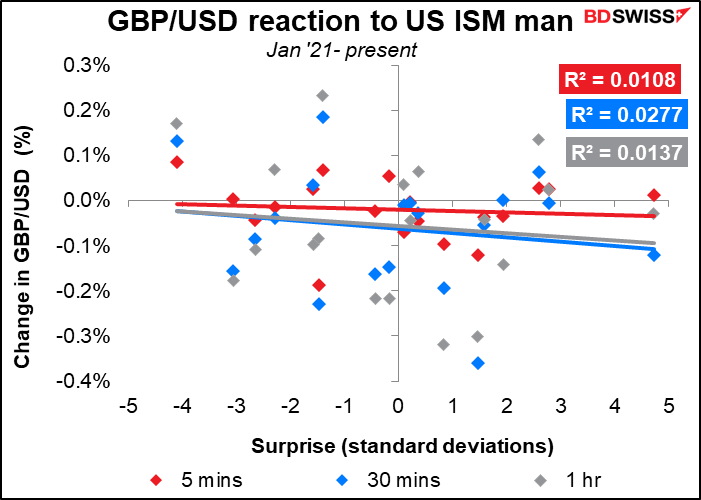

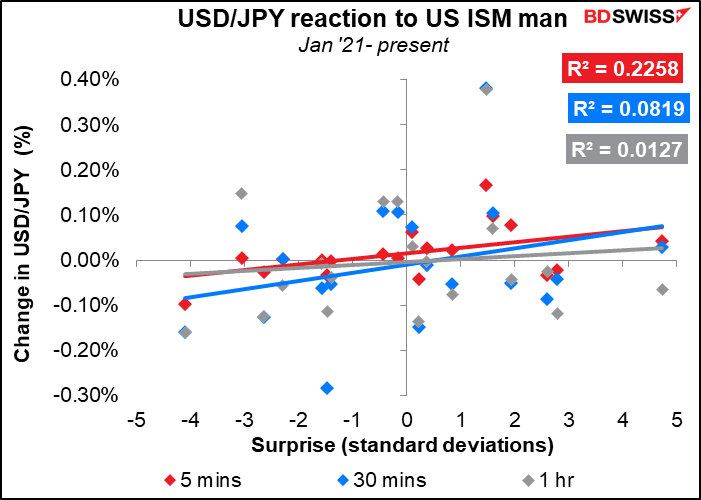

Anyone interested in trading the ISM manufacturing PMI should probably use USD/JPY, which has the highest correlation to the surprise in the index.

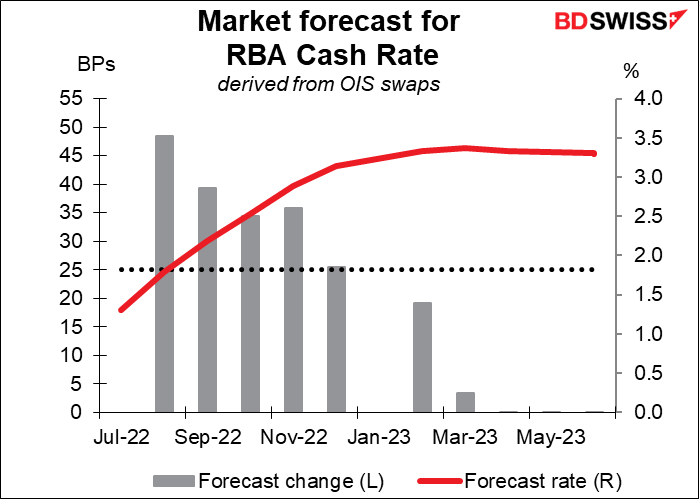

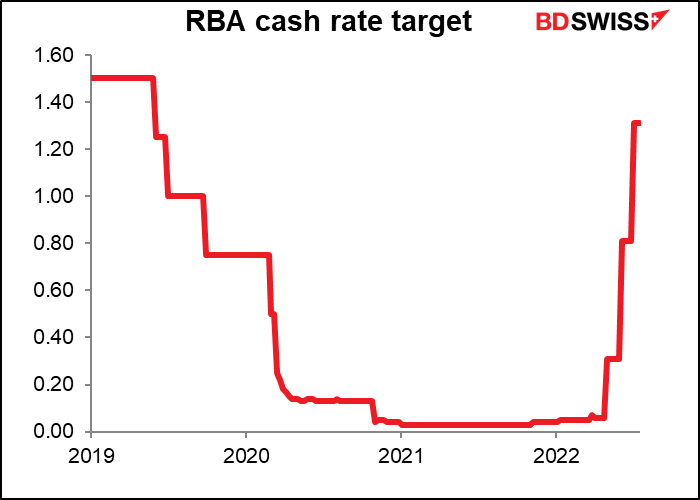

Then overnight the Reserve Bank of Australia (RBA) meets. The market forecast is for an increase of +50 bps. That seems about par for the course nowadays.

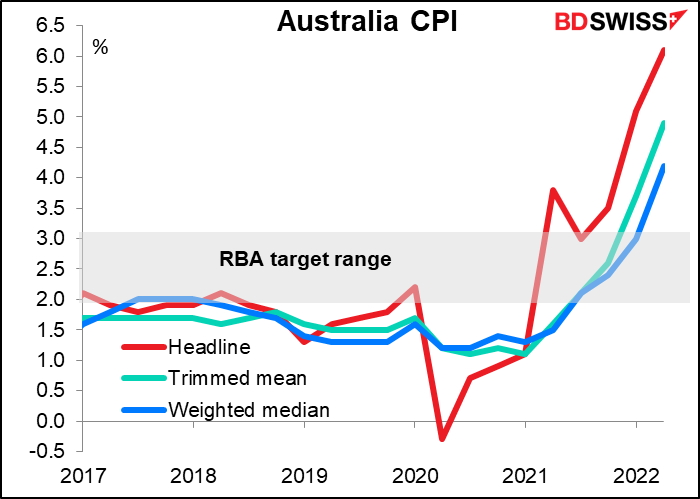

As you may remember, we just got Australia’s Q2 consumer price index (CPI) last week. It wasn’t as bad as expected but it was plenty bad: headline inflation rose from 5.1% yoy to 6.1% yoy. The quarter-on-quarter rate of +1.8% qoq is pretty near the RBA’s target for a whole year’s inflation (2%-3%). And the two core inflation measures are soaring far far above target, too. Need I say more?

With no sign of inflation slowing, the RBA is going to have to take some strong measures. They hiked by 25 bps in May, 50 bps in June, 50 bps in July…another 50 would seem to be in order at least. The forward guidance is likely to continue to say that the Board “expects to take further steps in the process of normalising monetary conditions in Australia over the months ahead,” i.e. watch out for further rate hikes.

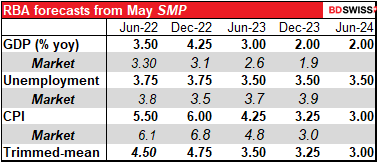

The markets will also be looking forward to the RBA’s revised forecasts on Friday with the release of the August Statement on Monetary Policy. I’d expect to see some of the key forecasts in the post-meeting statement Tuesday, as has been the custom under Gov. Lowe. Look for higher inflation and higher wage expectations to justify higher interest rates.

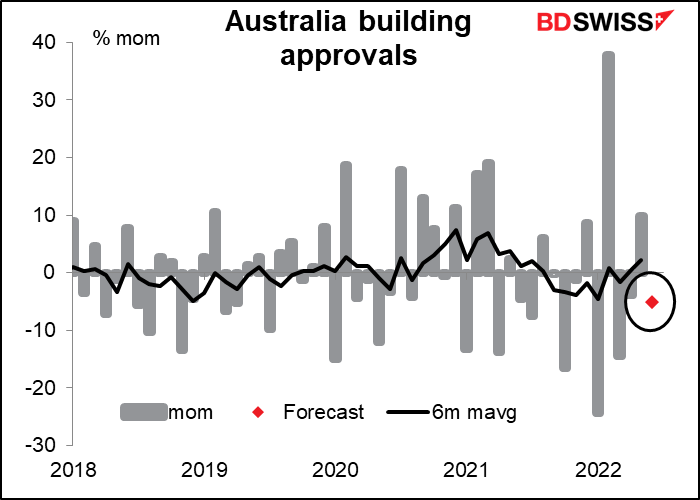

Three hours before the RBA meets, we get Australian building approvals. These can move the market even on RBA days – I’ve seen it happen. They’re expected to show some mean reversion after the large 10% rise in the previous month. The trend is surprisingly strong though considering that interest rates have been going up – I think there’s room for a downward surprise.